THE THRIFT INDUSTRY : Owner of Failed S&L; Selling Mansion for Record Price

- Share via

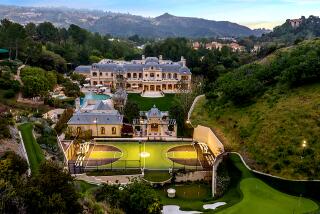

The owner of a failed savings and loan is selling his Newport Beach mansion for “close to the asking price” of $14.5 million, reportedly the highest price ever paid for a residential property in Orange County, the broker on the deal said Thursday.

Leroy Carver III is in escrow on a deal to sell the 18,000-square-foot house, still under construction on Harbor Island in Newport Harbor, said real estate agent William F. Cote.

The three-story structure, scheduled for completion in eight months, is being built mainly from a $7.9-million loan Carver obtained two years ago from his Carver Savings & Loan in Escondido, according to Orange County recorder’s office records.

The loan is not in default and Carver has made every payment requested of him, said a regulator who requested anonymity. If he pays off the loan with the sale proceeds, Carver stands to make a profit of up to $6 million, less the broker’s commission.

Cote declined to identify the buyer. But two other brokers said the house is being purchased by international businessman George Yao and his wife, Mimi. Last year, the Yaos bought the Newport Beach home of Los Angeles Rams owner Georgia Frontiere.

The house has 8 bedrooms, 7 fireplaces, 13 baths, a wine cellar for 10,000 bottles in a 6,000-square-foot basement and separate staff quarters. The facing of the house will be done completely in limestone--put on by hand piece by piece.

Outside, the boat dock is 165 feet long--the longest dock in the harbor, Cote said.

Regulators declared the S&L; insolvent on Jan. 27, seized it and closed it, transferring deposits to two healthy thrifts. It will cost the government nearly $58 million to pay off depositors at the failed institution.

The S&L; was funding major losses at its real estate development subsidiary, where its only two assets were poorly underwritten, overvalued and provided no cash flow, regulators said. The government has been investigating Carver’s role at the S&L.;

Carver resigned as chairman on Aug. 1, less than three months after a regulatory examination revealed that the S&L; failed to take $12.8 million in losses.

The loan to build his house was “very, very heavily reviewed” by regulators and their lawyers, said the federal regulator. FSLIC’s overseer, the Federal Home Loan Bank Board, demanded some time ago that Carver pay off a portion of the loan.

“He argued about it, but he paid about $2 million or so,” the regulator said.

Last September, Carver deeded the Newport Beach property to a living trust for the benefit of his wife, Julia, who is the beneficiary of 98% of the proceeds. Carver is the beneficiary of the rest, according to the recorder’s office records.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.